ICBC’s Enhanced Care Insurance Changes 2021

Enhanced Care Coverage available for BC citizens from May 1, 2021.

AP Insurance is here to help you understand the changes and how they will affect you.

Saving drivers money on their insurance while simultaneously offering new and enhanced recovery benefits should they be injured in a crash, whether they are found responsible or not.

How much will I save on ICBC rates?

While the amount saved varies by individual, the average BC driver should save up to 20%, or about $400, on their ICBC insurance. The average annual insurance premium for full ICBC basic and optional coverage for B.C. drivers was approximately $1,900 in 2020. Enhanced Care brings that average annual premium down to about $1,500.

Thank you for reading this post, don't forget to subscribe!Some of the factors affecting their savings include:

- Type of coverage

- Driving experience

- Crash history

- Where they live

- Type of vehicle

How does Enhanced Care apply to me?

Those who choose to purchase full coverage with optional extended third-party liability experience greater savings on their annual premiums for Enhanced Care coverage than those who purchase basic insurance.

With the changes that came into effect for all BC citizens on May 1st of 2021, the full savings should be seen on the first annual renewal following that date. Citizens are owed a pro-rated refund, which is the difference in rates for the period remaining on the current insurance policy policies that extends past May 1st. These refunds will be issued to the majority of eligible customers between mid-May and July 2021.

Refunds will be issued in one of three ways:

-

ICBC Payment Plan

If you are on the payment plan, you will receive your refund in the form of an adjustment to your monthly payments. -

Credit Card

Refunds will be issued to the credit card originally used. -

Cheque

Other refunds will be issued as a cheque. Alternatively, you may set up direct deposit by visiting icbc.com.

No matter how you get your refund, all customers will receive a letter from ICBC with the details of how it was calculated.

What are the Enhanced Benefits?

Under the new coverage, a variety of benefits have been enhanced and expanded:

Medical Care and Rehabilitation

There will be no maximum limit to your medical care and rehabilitation expenses. This offers greater support for those who have been injured in a crash during what may be a lengthy recovery. It can be applied to:

- Physiotherapy, occupational therapy, chiropractic, acupuncture, and massage therapy.

- Dental care, counselling, medication, and medical devices/ equipment.

- Crash Required alterations to vehicle or home, including ramps, stairlifts, and bathroom alterations.

- Expenses for travel and accommodations when out-of-town appointments are required.

Income Replacement Benefits

Individuals unable to work due to an injury will receive 90% of their net income in wage loss benefits. This is based on a maximum gross annual income of $100,000. Those with income over this amount may choose to purchase additional coverage to provide a higher wage loss limit.

Personal Care Assistance

Increased to approximately $ 5,000/ month for those in need of assistance with personal tasks such as dressing, bathing, eating, and housekeeping.

Death Benefits

The amount for a surviving spouse increases from the current $30,000 to $66,000 – $500,000. Benefits for dependants will also increase significantly, and funding for funeral expenses will be available to a maximum of $9,000.

New Enhanced Benefits

In addition to the enhanced benefits listed above, the new coverage also includes the following new benefits:

-

Caregiver Benefits

Family caregivers who are unable to fulfill their caregiving duties as a result of injury are eligible for this weekly benefit, starting at $580. -

Grief Counselling

Up to $3,800 is available to cover counselling expenses for grieving family members.

Benefits for Those Who Have Suffered Catastrophic Injuries

Those who suffer a catastrophic injury resulting in severe, permanent impairment that impacts daily life have three other benefits available to them.

-

Permanent Impairment Compensation

This new benefit provides financial compensation to a maximum of $265,000 depending on the severity and permanence of the injury. -

Personal Care Assistance

Increased to $6,000 per month for those with catastrophic injuries, or $10,000 per month for those who require assistance 24/7. -

Recreation Benefits

A maximum of $4,000 every 2 years (depending on the severity of the injury) is available for those who require support to engage in recreational and leisure activities.

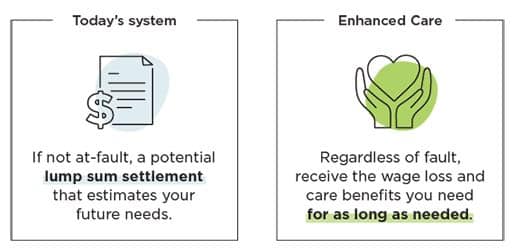

Enhanced Care Benefits

Previously, should you suffer a serious injury, you would be forced to make do with a one-time settlement. Under the new Enhanced Care Coverage, ICBC will now continue to provide for your medical care following an accident for as long as necessary. Your doctor or primary care provider will develop your recovery plan with the assistance of ICBC and the rest of your health care team (physiotherapists, etc.) to provide you the support you need for your recovery.

This enhanced care is made available to all BC citizens, regardless of responsibility in the crash. No one will be required to file a lawsuit against the at-fault driver, and those involved in single-car crashes will also receive the care they need. Drivers causing an accident do still face consequences in the form of higher premiums and may still be sued for compensation if found guilty of certain criminal code violations, such as impaired driving.

Enhanced care also provide individuals with 90% of their net pre-collision income in tax-free instalments even if they are at fault for the accident. The amounts paid will increase annually to match inflation, and at age 65, recipients will be eligible for retirement benefits from ICBC for the remainder of their lifetime.

The most vulnerable of road users—cyclists, and pedestrians—are not required to purchase ICBC insurance to be eligible for the benefits in the event of injury in a car accident.

Vehicle Damage Coverage

Additional changes include those made to vehicle damage coverage:

-

If you are not at fault

your repairs will now be covered by your own insurance and not that of the at-fault driver. This will not impact your premiums. -

If you are at fault

your repairs will be covered by your optional collision coverage, if you have it, though your premiums will be affected. If you do not have the optional collision coverage, either from ICBC or another insurer, you will be responsible for all repairs. -

Hit-and-run

In the event of a hit-and-run, there will be no change, provided you are covered by ICBC’s collision coverage. If you are not covered and do not have hit-and-run coverage from another provider, ICBC now offers an affordable new standalone coverage for hit-and-run incidents, which started in May 2021.

By removing the costs associated with lawyers and legal fees, ICBC can pass on those savings, making Enhanced Care Coverage possible, and providing greater care, recovery, and wage loss benefits for those injured in a crash.

Learn more about Enhanced Care

AP Insurance is here to guide you through the enhanced benefits changes, introduced in May 2021. We offer no-contact delivery of your ICBC Auto Plan to your door. Get in touch with us today if you have any questions regarding Enhanced Care.

CONTACT USSee More Information about Auto Insurance

AP Insurance is here to guide you through the enhanced benefits changes coming this May. We offer no-contact delivery of your ICBC Auto Plan to your door. Get in touch with us today and start start receiving your enhanced care refunds.

AUTO INSURANCE